Online Banking for Young Members

Sparkasse was planning to optimise the User Experience for Young Members in different stages.

Client

Sparkasse

Roles*

UX Research

*As a freelance UX/UI designer and UX Researcher I contributed to fragments of the Project. I didn’t have detailed and continuous insight of this project. I worked as a supportive role doing researches, benchmarkings, prototypings, qualitative usability testings, documentations. I work with multiple Sparkasse UX teams on this project for 9 months.

Methods

Qualitative Usability Test | Usability Test Script | Competitors Analysis | Prototyping | Documentation

1st stage: Signing Up for Sparkasse Account under 18

Briefing

The Task was to create a tangible Expert Review, based on the previous Usability Test, so Sparkasse UX Team could collect more credible arguments and present to the stakeholders for budget negotiation and further iteration roadmap planing. I was working closely with product owner, other UX researcher from another team and a UX writer.

Persona

In this stage the persona could broadly differenciate depending on the legal situation such as traditional family with two married couples, divorced couple, single parent, grandparents, orphanage etc. Reshaping traditional personas is one way we can put more focus on inclusivity. As UX expert, it is my job to advocate on behalf of all user. It is important to help the client and the Product team understand the users and to prioritize their needs. The more inclusive the product will be, the less confused users could be avoid through out the process. We could therefore increaser user trust and satisfaction.

Status Quo Costumer Journey Map

Before I started with the Expert Review, I decided to map out the current Costumer Journey for under 18 and compare it with the current Costumer Journey for Adults. Since that team were working on the power users, they were a step ahead with research and findings. I could have a view and discuss with Adult Account Team about their struggles and learnings. Even if two teams were working separately, it is important to recommend aligned solutions to the stakeholder. That will reduce the effort of stakeholders persuasion, coding and similar user journey testing.

Competitors Analyses

To create a credible Expert Review with useful recommendations, I did a research on 5 similar competitors costumer journeys. I analysed the solutions of each competitors. We could compare and see what Sparkasse lacked and could improve in their user journey.

Expert Review

Challenges

In the briefing the client delivered usability testing results and recommendations of the status quo done by another agency. In the middle of research and creation of the expert review, the client delivered a new visual design based on the recommendation from the usability testing. It was confusing which version should the expert review based on. I decided to look at the status quo version first and analyse what problem the users were encountering and ensure that the optimised version was solving that problem. In the expert review I tried to describe the problem and write recommendation based on more research sources such as competitors analysis, best practices and the usability testing. With such tangible argumentations I could justify my recommendation to the stakeholders and successfully persuade them of the importance of this optimisation.

Documentation of learnings and recommendations

The Insight of the Research and Expert Review were collected and analysed first in Miro Board. Learnings, key insights and recommendations were documented in a PowerPoint Presentation that could be used by various UX Teams, POs and Shareholders.

2nd stage:

Transition into adulthood

Recommend and create research plan to ensure the quality of the new solution for the case study when users become adults and receive the full access to their account and independency from their legal representative.

Briefing

In this stage the only personas are users that are turning 18 years old.

Persona

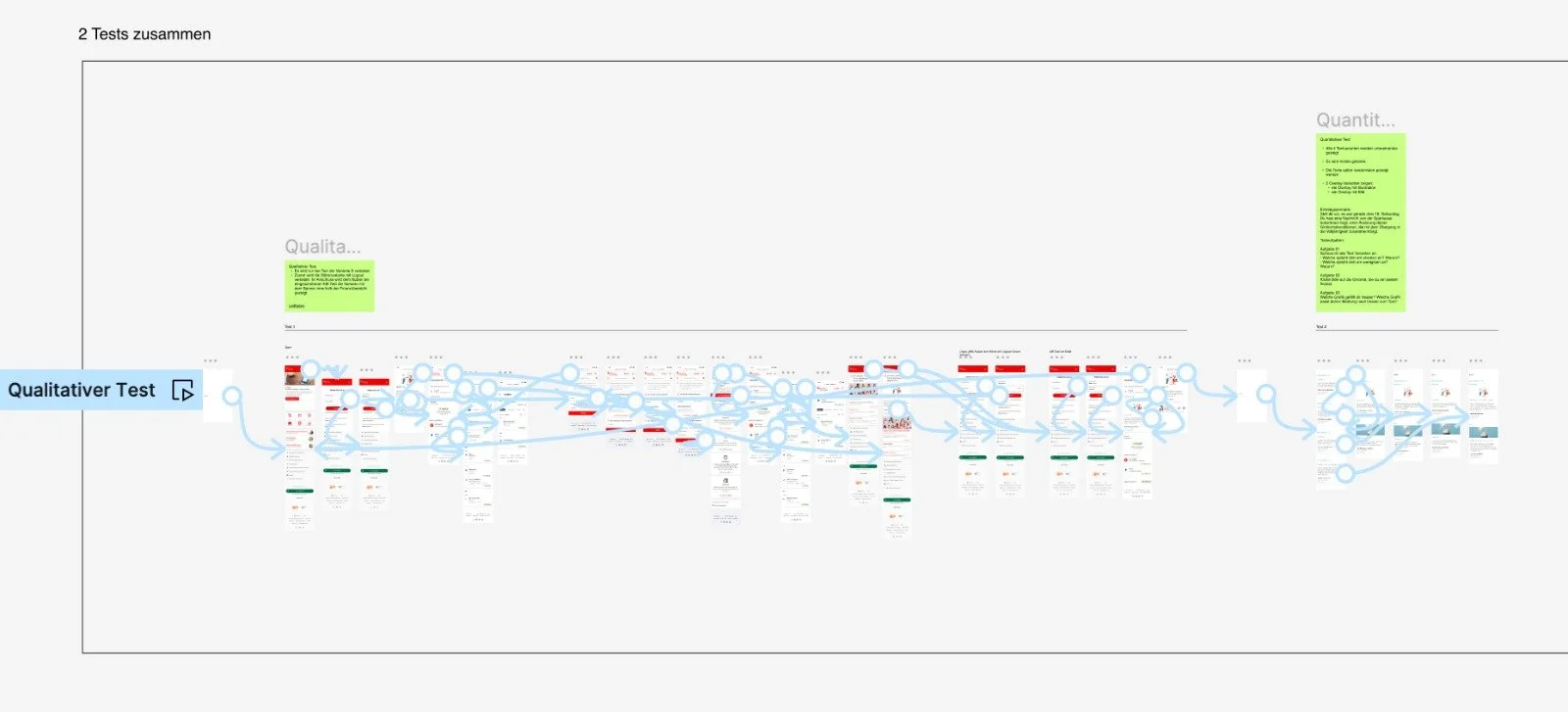

2 Prototypes based on recommended Usability Test

Testing moderation

Testing Analisys

Problem to recruit the right users since the target group are underage and must be already active Sparkasse client. It was not legal to approach underage users. The recruiting company also didn’t have underage in their testers pool. We had to iterate the Testing Set Up and recruit users who recently turned 18 and could be users of other online banking.